montgomery county maryland earned income tax credit

Montgomery County Council unanimously approved the Working Families Income Supplement Bill which alters certain requirements for residents to qualify for the Working Families Income Supplement WFIS. This is available for the 2021 tax year dependent on your adjusted gross income AGI.

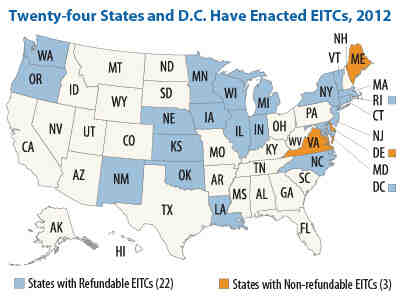

State Earned Income Tax Credits 2008 Legislative Update

28 of federal EITC.

. The local EITC reduces the amount of county tax you owe. For more information about the. As it was originally introduced Senate Bill 218 introduced by Sen.

The credit is equal to 50 of the federal tax credit. Thelocal EITC reduces the amount of county tax you owe. If the taxpayer qualifies for the Refundable EIC from the State of Maryland then they will receive an additional payment from Montgomery County called the.

In 1999 Montgomery County was the first local jurisdiction in the nation to introduce a Refundable Earned Income Credit EIC. Calculate your federal EITC. The Maryland earned income tax credit EITC will either reduce or.

Residents of Montgomery County pay a flat county income tax of 320 on earned income in addition to the Maryland income tax and the Federal income tax. Income Tax Offset Credit ITOC This County program grants a credit against the county real property tax in order to offset in whole or in part increases in the county income tax revenues resulting from a county income tax rate in excess of 26. King D-Montgomery would have created a refundable.

The Maryland business tax credit for Enterprise Zones provides a business incentive by offering income tax credits in return for job creation and investments. If you earn less than 57000 per year you can get free help preparing your Maryland income tax return through the CASH Campaign. Tax rate for nonresidents who work in Montgomery County.

EIC checks are administered and mailed to residents by the State of Maryland Comptroller Office for further information please call 4102607980. Claiming the Maryland EITC can mean owing less state taxes and the potential of an increased refund. This is available for the 2021 tax year dependent on your adjusted gross income AGI.

The Earned Income Tax Credit EITC is a refundable tax credit for people who worked in 2021. Montgomery County Refundable Earned Income Credit. Montgomery County Division of Treasury 27 Courthouse Square Suite 200 Rockville MD 20850.

Rock Hall Kent County 1532 12142031. It is important to note that Montgomery County is the only county in Maryland that offers a local income tax credit for its residents with a 100 percent match of the state earned income tax credit for the. The Earned Income Credit or EIC is a credit that is income based and is initiated by filing Maryland income taxes by April 15th of every year.

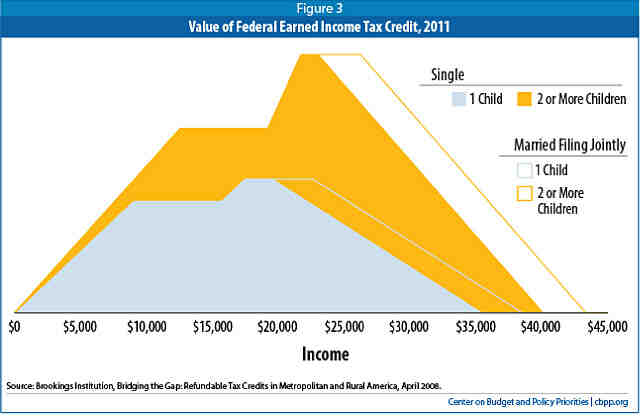

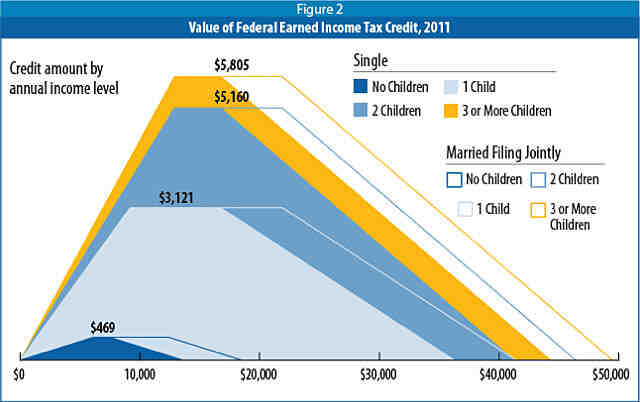

Montgomery County Refundable Earned Income Credit. Thestate EITCreducesthe amount of Maryland tax you owe. The maximum federal credit is 6728.

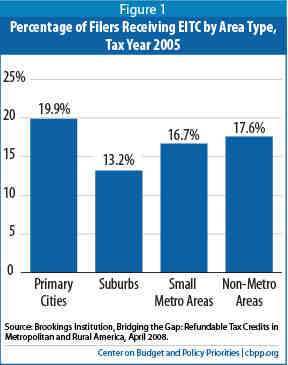

Find more information from the following links. Like the federal Earned Income Tax Credit the Maryland Earned Income Tax Credit MD EITC is designed to put more cash in the pockets of low- and moderate-income Maryland workers. Providing a local earned income tax credit to Montgomery County residents will enable approximately 13600 households to receive an average refund of 330 with a maximum of 614 once the State refundable portion is fully phased in.

50 of federal EITC 1. See Marylands EITC information page. EITC Information in Spanish.

If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the federal tax credit. You may be eligible to claim an earned income tax credit on your 2021 federal and state tax returns if both your federal adjusted gross income and your earned income are less than. BALTIMORE MD The Maryland Department of Human Services is strongly encouraging eligible Marylanders to take advantage of the Earned Income Tax Credit Benefit.

2021 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked. Earned Income Tax Credit EITC Rates. The Countys current income tax rate is 32 and the resulting Income Tax Offset Credit is currently 692.

The state EITC reduces the amount of Maryland tax you owe. Beginning with Levy Year 2017 properties that are determined to be not owner-occupied will have the credit removed. Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked.

Does Maryland offer a state Earned Income Tax Credit. Common EITC Questions and Answers. Some taxpayers may even qualify for a refundable Maryland EITC.

The Montgomery County Council passed Bill 48-16 which clarifies that the Income Tax Offset Tax Credit or ITOC this credit is labeled County Property Tax Credit on the property tax bill may only be granted to owner-occupied residential properties. By Online Ticket By phone. 4 Child Tax Credit CTC.

Nonresidents who work in Montgomery County pay a local income tax of 125 which is 195 lower than the local income tax paid by residents. If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the federal tax credit. Montgomery County Public Schools.

Qualifying Marylanders who claim it on their federal return may also be entitled to a Maryland. The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income. Required to file a tax return.

Marylanders who made 57000 or less in 2020 may qualify for both the federal and state Earned Income Tax Credits as well as free tax preparation by the CASH Campaign of Maryland. There is a regular State EIC and a Refundable EIC component. The Earned Income Tax Credit EITC is a benefit for working people with low to moderate income.

On March 5 2021 the Maryland General Assembly enacted Senate Bill 218 Child Tax Credit and Expansion of the Earned Income Credit. Some taxpayers may even qualify for a refundable Maryland EITC. Earned Income Tax Credit EITC.

Currently the law requires that in order to claim the WFIS tax credit a resident must be eligible and qualify for both the federal and state earned income tax credit. Eligibility and credit amount depends on your income family size and other factors. Earned Income Tax Credit EITC.

If you qualify for the federal earned income tax credit also qualify for the Maryland earned income tax credit. Income limits vary depending on your filing status AGI and the number of dependents. In May 2018 Maryland passed legislation to eliminate the minimum age requirement for the state-level EITC.

A Hand Up How State Earned Income Tax Credits Help Working Families Escape Poverty In 2011 Center On Budget And Policy Priorities

State Earned Income Tax Credit Prenatal To 3 Policy Impact Center

Earned Income Tax Credit Wikiwand

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Montgomery County Md 311 Answering To You

State Earned Income Tax Credits 2008 Legislative Update Center On Budget And Policy Priorities

A Hand Up How State Earned Income Tax Credits Help Working Families Escape Poverty In 2011 Center On Budget And Policy Priorities

Earned Income Tax Credit Wikiwand

Earned Income Tax Credit Wikiwand

Child Tax Credit Health And Human Services Montgomery County

3 Things You Probably Don T Know About The Earned Income Tax Credit

Montgomery County Volunteer Income Tax Assistance Program Vita

Eitc Earned Income Tax Credit Advantage Services

Montgomery County Volunteer Income Tax Assistance Program Vita

Vita Eitc Community Empowerment Initiative Cross Community

A Hand Up How State Earned Income Tax Credits Help Working Families Escape Poverty In 2011 Center On Budget And Policy Priorities